Reference module: Testing engagement policy conditions using audience simulation

U+ Bank, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when the customers log in to the web self-service portal. The bank now plans to amend its engagement policy conditions. As a Decisioning Consultant, which simulation do you run to check if the conditions are too broad or narrow for your requirements?

MyCo, a telecom company, notices that when customers call to check on bill status, 80% of the time, they received the wrong offer promotion, leading to customer dissatisfaction. The company decides to boost customers' needs in the prioritization formula, to improve sales in the current quarter.

Which arbitration factor do you configure to implement the requirement?

U+ Bank wants to send promotional emails related lo credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all credit card actions.

What do you configure to implement this requirement?

Reference module: Detecting unwanted bias

MyCo, a telco, has introduced mobile data packages for students. As a policy, MyCo does not want to discriminate based on gender when presenting the offers. As a Decisioning Consultant, how do you configure the ethical bias policy to allow no bias?

Reference module: Creating eligibility rules using customer risk segments.

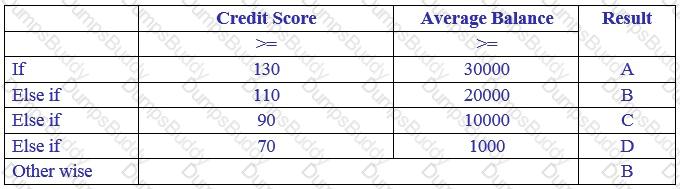

U+ Bank uses a decision table to return a label for a customer. Examine this decision table and select which label is returned for a customer with a credit score of 115 and an average balance of 15000.

Reference module: Creating and understanding decision strategies

In a Prioritize component, the top action can be determined based on the value of ________ .

U+ Bank is currently running outbound communications for home loan offers and credit cards. They have added five new actions to the Credit Cards group. They would like to enable these actions in the email channel. What are the two minimum configurations that must be made? (Choose Two)

In an organization, customer actions are applicable to various business issues. What is the best way to organize them?

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than USD150000.

What do you configure in the Next-Best-Action Designer to achieve this outcome?

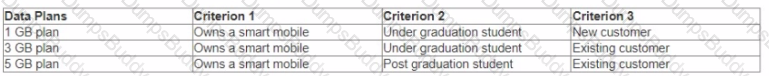

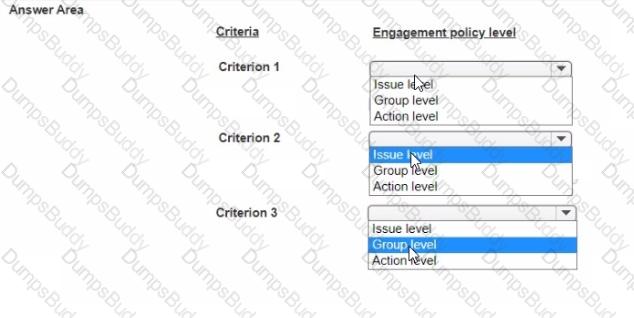

MyCo, a telecom company, developed a new data plan group to suit the needs of its customers The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

How do you configure the engagement policies to implement this requirement? Choose the engagement policy level that is best-suited for each criterion.

A volume constraint is configured to apply constraints to actions as a group rather than for each action individually. A customer qualifies for 3 actions, and the volume limit on the top-ranked action is above zero, the limits on the 2 lower-ranked actions have been reached. Given this scenario, how many actions will be selected for the customer in the outbound run?

U+ Bank currently uses Next-Best-Action Designer to manage 1:1 customer engagement in the web channel. The bank would like to promote the same offers in email. Which two additional configurations are needed in Next-Best-Action Designer to promote the offers in email? (Choose Two)

Reference module: Testing engagement policy conditions using audience simulation.

As a Decisioning Consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which of following statements is true when the simulation scope is Audience simulation with engagement policy and arbitration?

Reference module: Sending offer emails

What is best practice for designing an action flow?

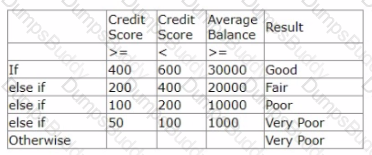

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

In addition to the credit risk requirement, U+ Bank wants to offer credit cards to customers whose age is greater than 25.

As a best practice, which part of Customer Decision Hub do you access to ensure that credit cards are offered only to customers with age greater than 25?

As a Decisioning consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which statement is true when the simulation scope is: Audience simulation with engagement policy and arbitration?

A bank wants to leverage the Next-Best-Action capability of Pega Customer Decision Hub™ to promote new offers to each customer on their website. What information does Pega Customer Decision Hub send back to the website in response to the real-time container request?

Reference module: Testing engagement policy conditions using audience simulation.

U+ Bank, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when the customers log in to the web self-service portal. The bank now plans to amend its engagement policy conditions. As a Decisioning Consultant, which simulation do you run to check if the conditions are too broad or narrow for your requirements?

A bank has several credit card offers defined under the sales issue / credit card group. The card_type action property for some of the cards is set to VISA and for others to Mastercard. The bank wants to limit the total number of VISA cards sent via email in an outbound run. How do you implement this requirement?

U+ Bank’s marketing department currently promotes various credit card offers by sending emails to qualified customers. Now the bank wants to limit the number of emails sent to their customers irrespective of past outcomes with a particular offer and customer. Which of the following options allows you to implement this business requirement?

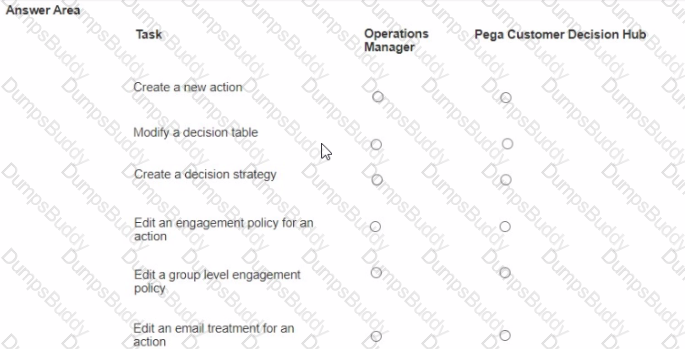

U+ Bank, a retail bank, uses the Business Operations Environment to perform its Business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 operations Manager Portal.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of an engagement policy condition. In which portal do you create the change request to fulfill new business requirement?

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach.

The company is introducing a new data plan.

To offer the new data plan, what must the mobile company focus on when implementing the Next-Best-Action paradigm?

U+ Bank has launched a new credit card for all customers with a premium bank account. As a decisioning consultant, you need to create actions that involve the full customer life cycle: marketing, sales, and service.

Which two valid actions do you create? (Choose Two)

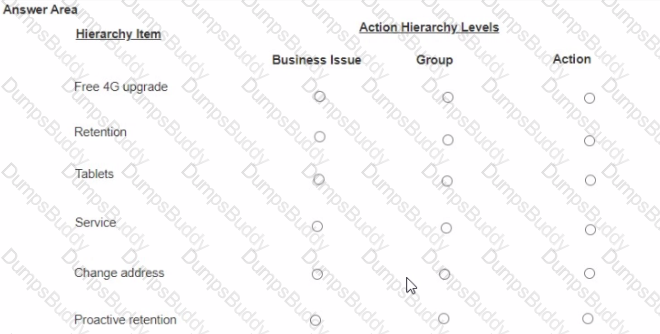

As a decisioning consultant you are setting up the action hierarchy for MyCo Select the correct action hierarchy level for each of the hierarchy items identified.

A bank wants to leverage Pega Customer Decision Hub’s Next-Best-Action capability to promote new offers to each customer on their website. Which artifact do you need to configure to manage the communication between the Customer Decision Hub and external channels?

Reference module: Creating and understanding decision strategies. Enrichment decision components provide the ability to ________.

U+ Bank wants to offer a 10% discount for customers whose CLV value is higher than 400. Which strategy component should you use to meet the new requirement?

You are the decisioning consultant on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

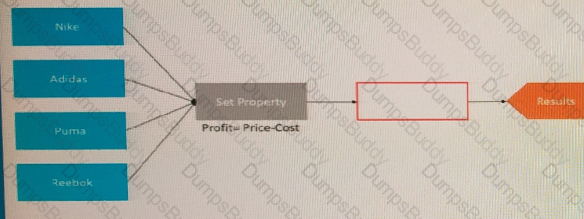

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Price of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

According to the decision strategy, what is the output of component in the blank space highlighted in red?

A bank is currently doing cross-sell on the web by showing various credit cards to its customers. Due to the credit limits of each card, the bank wants to present credit cards only to suitable customers who have a credit score greater than 500. Which component helps you to calculate a customer’s credit score?

In a Decisioning Strategy, which decision component is required to enable access to the Customer properties like age, income, etc.?

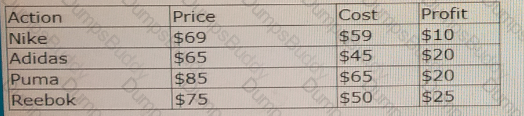

A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within 15 days.

Put the steps in the correct order to implement this task.

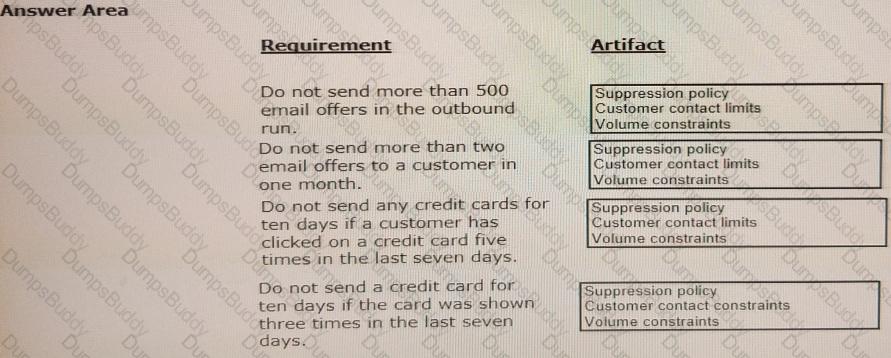

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. The bank wants to limit the number of offers that customers can receive over a given period of time.

In the Answer Area, select the correct artifact you use to implement each requirement.

What is the name of the property that is automatically recomputed for each decision component?

U+ Bank a retail bank, uses the Business Operations Environment to perform its business changes The bank carries out these changes m the Pega Customer Decision Hub portal by using revision management features or the V1 Operations Manager portal

For each task, select the correct portal in which the tasks are performed based on best practices

Pega customer Decision Hub enables organizations to make Next-Best decisions. To which type of a decision is Next-Best-Action applied?

For a limited time period, a bank wants to avoid sending promotional emails related to credit card offers to a customer if they have already received one. Which rule do you need to define to implement this business requirement?

A bank has been running traditional marketing campaigns for many years. One such campaign sends an offer email to qualified customers on day one. On day five, the bank presents a similar offer if the first email is ignored.

If you re-implement this requirement by using the always-on outbound customer engagement paradigm, how do you approach this scenario?

U+ Bank, a retail bank, follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card. Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. You have already created an action flow template with the desired flow pattern and reused it for all the credit card actions.

What must you do to ensure that this action is not selected for any customers?

Myco, a telecom company, uses Pega Customer Decision Hub™ to present offers to qualified customers. The business recently decided to send offer messages through the email channel. The Design department has designed an email treatment which includes dynamic placeholders.

As a decisioning consultant, what do you use in order to test the visualization and the rendering of the email content, including replacing of the placeholders with customer information?

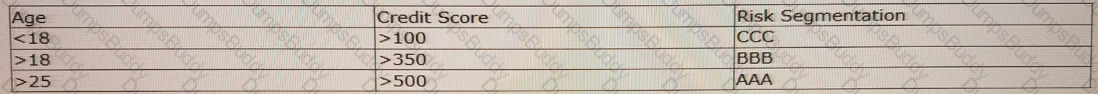

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning consultant, how do you implement the business requirement?

Reference module: Avoiding overexposure of actions in outbound.

U+ Bank’s marketing department currently promotes various credit card offers by sending emails to qualified customers. Now the bank wants to limit the number of emails sent to their customers irrespective of past outcomes with a particular offer and customer. Which of the following options allows you to implement this business requirement?

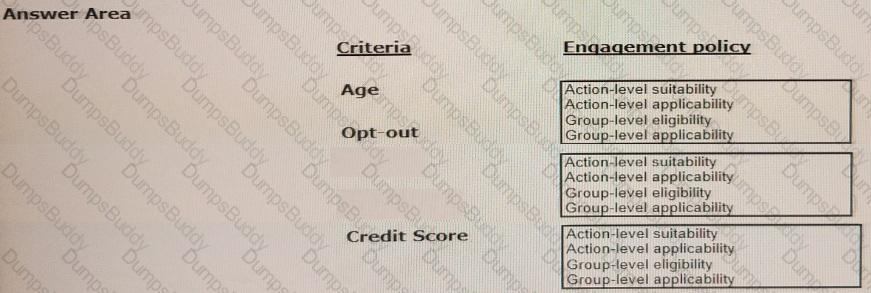

U+ Bank, a retail bank, has introduced a credit cards group with Gold card and Platinum card offers. The bank wants to present these two offers based on the following criteria:

1. For both cards, customers must be above the age of 18

2. Offer both cards only if the customer does not explicitly opt-out of any direct marketing for credit cards

3. Platinum card is suitable for customers with the Credit Score > 500

As a decisioning consultant, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

Reference module: Creating and understanding decision strategies.

What does a dotted line from a Group By component to a Filter component mean?

U+ Bank wants to introduce a new group of offers called Credit cards for all customers. As a decisioning consultant, which two valid actions do you create? (Choose Two)

Myco, a telecom company, has recently implemented Pega Customer Decision Hub™. Now, the company wants to move away from traditional marketing and leverage the always-on outbound capabilities.

What artifact do you configure to translate the traditional segments used to identify the target audience?

Reference module: Analyzing the effect of business changes using Pega Scenario Planner

U+ Bank, a retail bank, completed an implementation to present Credit Card offers to customers on their self-service portals. You want to estimate the business value that the subsequent next-best-action run creates using the selected configuration. Which simulation do you run to get the required information?

U+ Bank realizes that customers have ignored a particular mortgage offer. As a result, the bank wants to offer the action 30% more frequently. Which arbitration factor do you configure to implement this requirement?