A product requires one each of three different components.

Faulty components are identified only at the end of the manufacturing process.

The following average fault rates have been identified:

Component A – 1 in 100

Component B – 1 in 20

Component C – 1 in 10

The probability that a unit of finished product contains no faulty components is:

An organization's transfer pricing system involves:

• The transferring division receiving $20 per unit; an amount equal to its variable costs.

• The receiving division paying an additional $30,000 every month to the transferring division.

Which transfer pricing system is the organization using?

Oliver owns a computer repair company. He is looking to close of of his departments as the demand for computer cleaning has dropped dramatically in the last 2 years and is no longer profitable.

The contribution margin of the department is £12,000, and the overheads are £23,000 (out of which £4,000 cannot be eliminated).

How would closing this department impact operating income?

A not-for-profit organization measures performance using the three Es. If the organization has made optimum utilization of available resources then it should be described as:

The money cost of capital is 12%. The expected rate of inflation is 4%. What is the real cost of capital?

Give your answer to 2 decimal places.

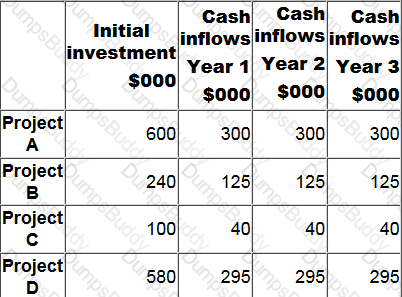

The following information is available for four investment projects:

A discount rate of 12% is appropriate for all four projects. The organization is subject to capital rationing and wishes to prioritise the projects using the profitability index (PI).

Which project has the highest PI?

Three years ago the large number of faulty products being returned by its customers resulted in a company adopting total quality management (TQM). The company has increased expenditure on staff training and product inspections. This has resulted in a reduction in the number of faulty products returned.

Which of the following statements is correct?

An organization is competing in the high technology market. It sets a high sales price for its products initially to target the early adopters, and then the price is gradually reduced.

This pricing strategy is known as:

A company is investing in a huge diversification project. The plan is to develop and sell a whole new product line that they have never sold before. They've already started a massive marketing campaign for this new

product line and they are getting good feedback in their market research.

They've had to use debt funding in order to finance the project, but they hope that the returns will be worth the investment and restructuring. If they are successful they will be a step ahead of all their competitors and offer

something none of them can.

What is the risk appetite of this company?

There is a 60% probability of a project yielding a positive net present value (NPV) of $280,000 and a 30% probability of it yielding a positive NPV of $140,000.

The only other possible outcome is that the project will yield a negative NPV of $160,000.

What is the expected value of the project's NPV?

When making an investment decision, which THREE of the following are reasons why receiving $1 today is preferable to receiving $1 in the future?

An organization has a decentralized structure in which division A supplies division B with an intermediate product for which there is no external market. Division B carries out further processing and then sells the final product on the external market. Due to organizational policy the current transfer pricing basis is variable cost.

The manager of division A has stated, "The current transfer price is unfair because it does not enable us to recoup our costs".

The manager of division B has stated, "The current transfer pricing system enables us to quote competitive prices for the finished product".

The Chief Executive of the organization is considering imposing a transfer pricing policy that uses dual pricing.

Dual pricing would:

A division of a company transfers all its output to other divisions in the same company.

For this division, which of the following measures is NOT affected by the transfer price that the division uses?

Which of the following factors would prevent a learning curve being observed for a task?

A company has just received the latest in a series of annual payments; this payment was $620. The annual payments are expected to continue for three more years with each payment being increased by the expected rate of inflation. The real cost of capital is 8% per year and the expected rate of inflation is 6% per year.

What is the present value of the future payments the company expects to receive?

Give your answer to the nearest $.

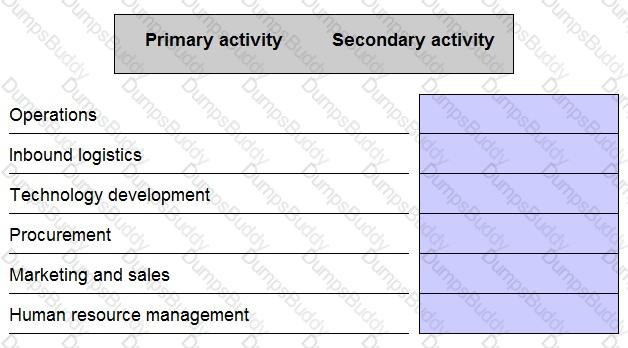

Place the correct category of Value Chain activity against each of the activities described below.

SkillWeave Industries are focused on managing the risk of selling their cars to the region due to economic turmoil, and have now begun using funds from sales in the region to fund supplier purchases from that region to

reduce the risk from the volatile currency. However, SkillWeave want to go a step further and make the risk even less sizeable.

Which of the following is a method by which SkillWeave can operate in the market and transfer the risk of exchange rate exposure to another party?

Which of the following statements is TRUE about the activity based costing system when compared to absorption costing method?

How does beyond budgeting NOT help to resolve the weaknesses of traditional budgeting? Select ALL that apply.

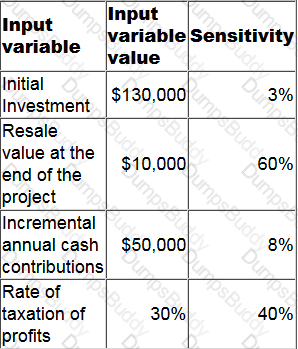

A project is viable because it has a positive net present value (NPV).

Details of four of the input variables, together with the sensitivity of the viability of the project to a change in each one in isolation, are given below.

Which of the following statements is correct?

A company operates a divisional structure. The manager of division D receives a bonus based on the division's annual return on capital employed (ROCE).

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus.

The manager is considering an investment in a new machine for next year. The incremental ROCE earned by the machine is expected to be 19% although the ROCE for the division as a whole with the machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%.

The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?

A senior manager is concerned about the dysfunctional consequences of a company's current approach to budget preparation. The senior manager has discovered that budget holders are carrying budgetary slack forward from one period to the next without this being identified or challenged.

Which of the following approaches to budget preparation is the company using?

Using Porter's value chain, place the tokens to correctly categories the following activities of a manufacturing company.

Which TWO of the following are reasons why cost-based approaches to transfer pricing are often used in practice?

The performance of an investment centre manager is assessed by return on investment (ROI) alone. At present, his expected ROI for next year is 15%. The manager must now decide whether to invest in a new project that is expected to yield an ROI of 14%. The cost of capital is 12%.

Indicate whether each of the following statements is true or false.

Which of the following is the ideal basis to use for a transfer price when there is a perfect external market?