Mayank an investor buys one share of stock for Rs.500 at the beginning of the first year, and buys another share for Rs.550 at the end of the first year. The investor earns Re.10/- in dividends in the first year and Re.20/- in the second year. What is the time-weighted rate of return if the shares are sold at the end of the second year for Rs.650/- each?

What would be the taxable value added in Dr. Vijay Mohan’s income for Gratuity receipt of Rs. 8,00,000 at the time of retirement. He is covered under the Payment of Gratuity Act 1972. He retired after 28 years of service with monthly salary of Rs. 40000 p.m. Assume Income Tax provisions pertaining to AY 2011-12 would be applicable at the time of retirement?

Under the Payment of Gratuity Act, 1972, where the employee employed in a seasonal establishment is deemed to be in continuous service for such period if he actually worked for not less than __________% of the number of days on which the such establishment was in operation during such period.

Yash pays health insurance premiums for himself, his wife and his two children aged 13 and 8. Premiums for which of these individuals will qualify as deductible from Yash’s taxable income?

Total income of an individual including long-term capital gain of Rs. 50,000 is Rs. 1,10,000, the tax on total income shall be:

Domiciliary Hospitalization Benefit is provided if treatment is taken for a period exceeding 3 days at home in India, provided _______________.

An important financial institution that assists in the initial sale of securities in the primary market is the

Commutation of pension up to a limit of _______________ is tax exempt in case the gratuity is also received

Sunil insured the building of his house for a sum of Rs.500000 against fire insurance. One day the house is totally gutted in a devastating fire. The insurance surveyors certified that the building is a total loss with no salvage value and that the insurable value of the building just prior to the loss was Rs.1000000. The insurer will pay to Sunil:

If a stock GHI ltd pays an annual dividend of Rs. 5 and plans to follow this policy for ever, then what would be the ate of return that investor would realize given the current market price of stock is 100

Compulsory audit of account is required u/s 44AB of IT, if the total sales/ turnover exceed _______

Nishant aged 35 years is married and is working as a manager in M/s Zenith Ltd. His most likely retirement age is 60 years.His present salary is Rs. 3,00,000/- pa and self-maintenance expenses are 30,000/- per year. He pays Life insurance premium paid of 15,000/-and Income tax & professional tax amount to Rs. 20000/-. Rate of interest assumed for capitalization of future income is 8%.

Calculate Nishant’s HLV to recommend adequate insurance cover.

Binoy aged 30 years with a total income is 6,00,000 p.a pays Rs.25000 as LIC premium for a policy of 3 lakhs on his life. He also pays income tax of Rs. 30,000. His retirement age is 65. The self maintenance expenses are 1 lakh p.a. & rate of interest is 6% p.a. Calculate the total amount of insurance requirement under HLV method?

A 12 year annual annuity of Rs. 10000 will begin 8 years hence (the first payment occurs at the end of 8 years). What is the present value of this annuity if the discount rate is 14 percent?

You are given the following set of data on security XYZ:

Calculate the expected return on security XYZ?

Mr. M by a Gift deed transferred certain property to her daughter, with a direction that daughter should pay an annuity to Mr. M's brother, as had been done by Mr. M. On the same day, the daughter executed a deed in writing in favour of Mr. M's brother, agreeing to pay annuity. Afterwards, she declined to fulfil her promise saying that no consideration had moved from her uncle. Which of the following statements is correct'?

The June 1999 Basle Committee on Banking Supervision issued proposals for reform of its 1988 Capital Accord (the Basle II Proposals). These proposals contained mainly in:

The portfolio manager adds new stock to a portfolio. The stock has the same standard deviation as the existing portfolio but a correlation of coefficient with the existing portfolio that is less than +1.What effect will adding the new stock have on standard of the revised portfolio?

Given the following data, which one of the options will be monthly premium installment?

Rebate for large sum assured

Upto Rs. 24,999/- No rebate

From Rs. 25,000/- to 49,999/- @ Re 1 per thousand SA

From Rs. 50,000 and above @ Rs. 2 per thousand SA

Rahul and Priyanka went to a wealth manager. Both of them have just got married. Their funds are limited and their needs are many.

Some of their needs are:

Kindly suggest the order in which they should start providing for their above needs:

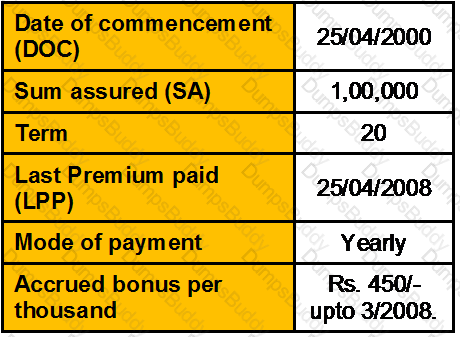

From the following information:

The Surrender value is 43% of the paid up value and loan is available at 85% of surrender value.

Calculate paid up value, surrender value, and loan value

Balance on current account + balance of capital account + balance on reserves account is equal to ___________

A ………………… mortgage is a mortgage which does not fully amortize over the term of the note thus leaving a balance due at ……………..

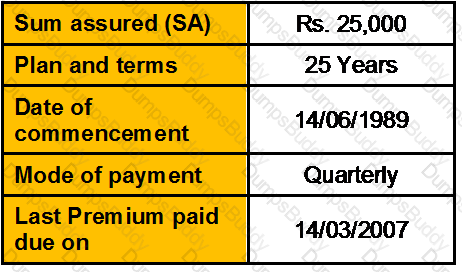

Calculate the Paid up Value ( PV) under a policy with the following particulars

A Post Office Recurring Deposit account can be prematurely closed after _______ years and ________ interest would be payable on prematurely closed account.

An investment having market value of Rs. 100 lakhs in the beginning of 2007, a Rs. 200 lakhs value at the end of 2007, and a Rs. 100 lakhs value at the at the end of 2008. Calculate the arithmetic return and time-weighted return?

Once the child reaches the vesting age, i.e. the age when the life assurance commences, he or she can claim cash option i.e. he can opt to receive the premium amount paid so far under the policy in case the policy is discontinued. This is possible under:

Vikrant Juneja gifted his house property to his wife in year 2007. Mrs. Juneja then lets out this house @ Rs. 5000 per month. The income from such house property will be taxable in the hands of:

Mr. Patel has analyzed a stock for a one-year holding period. The stock is currently quoting at Rs 80/- and is paying no dividends. There is a 50-50 chance that the stock may quote Rs 90 or Rs 110 by year-end. What is the expected return on the stock?

Find out the effective quarterly rate for 18% per annum compounded half yearly.

If you have deposited Rs.4000 with a company and the company wishes to prepay the deposit at the contracted rate of interest after a period of 3.5 years and offers you Rs.4985, what is the effective rate of interest if it is accounted half yearly?

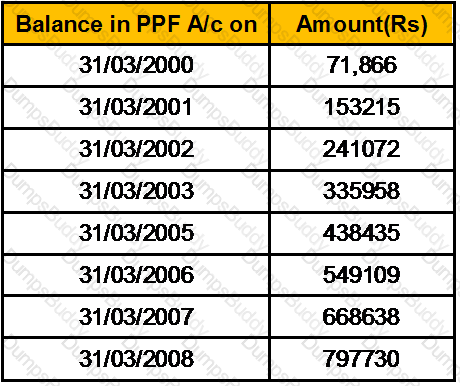

Dinesh has opened his PPF account on 19/11/1999, Calculate the amount he can avail as the first withdrawal facility from the details below?

Returns on a security held for 5 years by Praveen are:

Find the standard deviation of the security.

Mr Ram aged 53 years has put in 21 years of service in a PSU opts for a voluntary retirement under the company scheme. He has 5 years and 3 months of service left and his last drawn salary is Rs 18,000. He received Rs 10,00,000 as compensation. What would be the taxable part of this receipt?

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

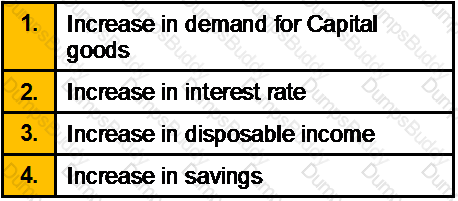

Movement through phases of the business cycle is initiated by shifts in aggregate demand which create fluctuations in GDP. Which combination of the following statement would be the most significant contributor to the upward shift in aggregate demand?

Mr. Subhash Bansal, a marketing manager is employed with IMFB limited. He took an advance of Rs. 1,20,000 against the salary of Rs. 30,000 per month in the month of March 2007. The gross salary of Mr. Adhikari for the assessment year 2007-08 shall be:

The relevant banking ombudsman for filing a complain regarding credit card with central processing is the one under whose jurisdiction __________________?

A money back policy for SA of Rs. 100000/-. Matured after 25 years. Survival benefits of 15% each has been paid at the end of 5th , 10th, 15th, and 20th years. Bonus has accrued at Rs. 965/- per Rs. 1000 SA. Interim bonus @ Rs. 25/- per thousand SA is payable. What is the maturity claim amount?

If a preferred stock pays an annual Rs. 4.50 dividend, what should be the price of the stock if comparable yields are 10 percent? What would be the loss if yields rose to 12 percent?

The relevant banking ombudsman for filing a complain regarding credit card with central processing is the one under whose jurisdiction __________.

A borrower defaults on a secured loan of Rs. 50,000. The underlying security is worth Rs. 60,000. Which of the following is true? "

"A borrower who has been given notice of enforcement of security interest, replies with his objections. What is expected of the secured creditor? "

X owns a piece of land situated in Varanasi ( Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-) On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.5 lakh. And X does not dispute it. [CII-12-13: 852,11-12: 785,10-11:711]

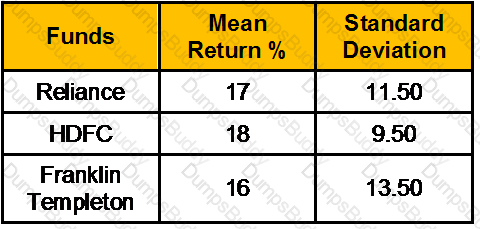

From the following data on mutual funds, Calculate the Sharpe Ratio.

Risk free return is 8%.

What is the portfolios standard deviation if you put 25% of your money into stock A which has a standard deviation of 15% and rest into stocks B which has a standard deviation of 10%. The correlation coefficient between the returns of the stocks is .75.?

Mr. Ajay and Vijay both are 30 years old. And both are 30 years away from their retirements. Ajay saves Rs. 10,000/- p.a. for 8 years and stops. Vijay starts investing after Ajay stops and saves Rs. 10,000/- p.a. till he retires. Their savings earn 10% p.a. compounded yearly. At the retirement what is true?

Vinod is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2 months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6months and Rs. 800 for 2 months thereafter. Please calculate the Present Value of this cash stream if rate of interest is 9%

Mohan is a manager in ABC Co. Ltd. His family consists of his wife and child. It is assumed that his family needs a minimum of Rs. 10,000 per month to maintain current standard of life in unfortunate case of demise of Mohan. The interest rate is 6% pa. Calculate how much insurance is required under income replacement method?

Ashish owns three stocks & has estimated the following joint probability distribution of returns:

Calculate the portfolio’s expected return & standard deviation if Ashish invests 20% in stock X, 50% in stock Y & 30% in stock Z. Assume that each security is completely uncorrelated with the return of other securities.

Sonia works at the post office. She deposits Rs. 1000 on every birthday into a retirement plan which paid an interest rate of 8% from the age of 20 years until she retired. If she had Rs. 260000 in her retirement plan when she retired, at what age did she retire?

Suresh is an employee of a private company in Mumbai. He draws an amount of Rs 36,000pm as basic salary. He also receives Rs 8000 as HRA. He has taken a house on rent from 1st October and pays Rs 10,000pm as rent for his house accomodation. What would be the taxable HRA?

Omar wants to make a gift of Rs. 10000 in today’s terms to his parents at the end of each of next 10 years. If the annual rate of return is 8% and inflation is 3%, what is the value of funds he must have in hand today to meet this need for the 10 year period?

R acquired a property by way of gift from his father in the previous year 1991-92 when its FMV was Rs. 3 lakh. The father had acquired the property in the previous year 1983-84 for Rs. 2 lakh. This property was introduced as capital contribution to a partnership firm in which R became a partner on 10/06/2011. The market value of the asset as on 10/06/2011 was 10 lakh, but it was recorded in the books of account of the firm at Rs. 8 lakh. Compute the capital gain chargeable in the hands of R.

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

Smt. Rajalakshmi owns a house property at Adyar in Chennai. The municipal value of the property is Rs. 5,00,000, fair rent is Rs. 4,20,000 and standard rent is Rs. 4,80,000. The property was let-out for Rs. 50,000 p.m. up to December 2010. Thereafter, the tenant vacated the property and Smt. Rajalakshmi used the house for self-occupation. Rent for the months of November and December 2010 could not be realized in spite of the owner's efforts. She paid municipal Texas @12% during the year. She had paid interest of Rs.25,000 during the year for amount borrowed for repairs for the house property. Compute her income from house property for the A.Y. 2012-13.

Your client, a businessman has a house worth Rs. 2.1 crore and a farm house worth Rs. 85 lakh. His business is worth Rs. 10 crore as per last balance sheet. He has two other partners in the business having stakes of 24% each. He has two cars purchased at Rs. 40 lakh and Rs. 20 lakh, the latter being in personal account. The cars have depreciated/market value at Rs. 30 lakh and Rs. 8 lakh, respectively. His joint Demat account, wife being primary holder, has stocks worth Rs. 1.65 crore. The business has taken Keyman‟s insurance on his life of value Rs. 1.5 crore. He has himself insured his life for an assured sum of Rs. 1.5 crore. You evaluate your client’s estate in case of any exigency with his life as _____.

Saurabh contributes Rs. 10,000 every year starting from the end of the 5th year from today till the end of 12th year in the account that gives a ROI of 7.75% p.a. compounded half yearly. Calculate the Present Value of his contribution today.

Yogesh Jain is a Chartered Accountant by profession and a very disciplined investor he has started investing from today in an account Rs. 1,00,000 every year (beginning of year) and plans to increase his contribution by 10% every year. If the ROI he gets is 15% per annum compounded half yearly calculate the corpus he would be able to accumulate in 25 years.?

Given the following diversified mutual fund performance data, which fund has the best risk adjusted performance if the risk free rate of return is 5.7%

Rs. 1.50 lakh settled on a trust for the benefit of Akash and Bina for life. They share the income in proportion of 3:2.Their ages on valuation date are 20 years and 16 years. The average annual income for the last three years on the valuation date is Rs. 15,000/-. Find out the value of life interest of Akash and Bina if the value of life interest of Re 1/- at the age of 20 years is 12.273 and at the age of 16 years is 12.534.

Asit an industrialist wants to buy a car presently costing Rs. 10,00,000/- after 5 years. The cost of the car is expected to increase by 10% pea for the first 3 years and by 6% in the remaining years. Asit wants to start a SIP with monthly contributions in HDFC Top 200 Mutual Fund. You as a CWM expect that the fund would give an average CAGR of 12% in the next 5 years. Please advise Asit the monthly SIP amount starting at the beginning of every month for the next 5 years to fulfill his goal of buying the Car he desires.

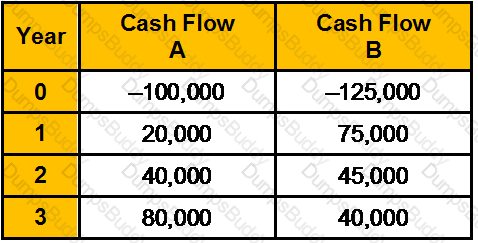

What is the present value of the following cash flows,if the Interest rate is 8%?

The management of Pearls India Shopping Ltd has recently announced that expected dividends for the next three years will be as follows:

For the remaining years, the management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

You have a choice between 2 mutually exclusive investments. If you require a 15% return, which investment should you choose?

Yami Ltd is a one of most accredited tours and travels company in India. It pays dividend per share of Rs. 0.24 on reported earning per share of Rs. 0.512 in 2011. The firms earnings per share have grown at 8% over the prior 5 year but that growth rate is expected to decline linearly over the next 5 years to 3%, while the payout ratio remains unchanged. The beta for the stock is 0.9. The risk free rate is 4.2% and the market risk premium is 4%.

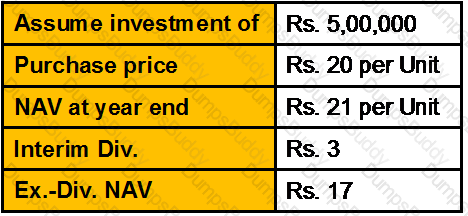

Calculate the total return on the mutual fund investment with the below mentioned information:

Mr. Kadam is entitled to a salary of Rs. 25000 per month. He is given an option by his employer either to take house rent allowance or a rent free accommodation which is owned by the company. The HRA amount payable was Rs. 5000 per month. The rent for the hired accommodation was Rs. 6000 per month at New Delhi. Advice Mr. Kadam whether it would be beneficial for him to avail HRA or Rent Free Accommodation. Give your advice on the basis of “Net Take Home Cash benefits”.

Vinod joined on 01/01/90 in ABC Ltd. and retired on 01/01/2007.Employee paid leave encashment of Rs. 4,00,000/-. His last drawn salary is Rs. 25000/-. His last 10 months average salary is 23500/-. He availed 150 days leave during the service. What will be his taxable leave salary amount?

Ankur Kalra is 33 years old finance professional. The house hold expenditure of Mr. Kalra is 20,000/- p.m. to maintain his current living standard. He assumes that his living standard will increase 1.5% annually until his retirement at 60. His life expectancy is 70 years. At retirement he needs 75% of his last year’s expenses. Inflation rate for the next 45 years is expected to be 4% p.a.

Calculate how much would Mr. Kalra require in the first year after his retirement, and how much he has to save at end of every year to accumulate this corpus, if the return on investment is 7% p.a.?

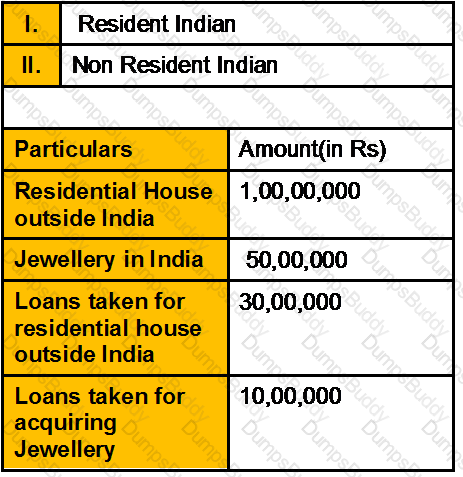

From the following information of assets assets and liabilities, the taxable wealth for:

How much amount should be invested by Mr. Batra today to get a maturity value of Rs. 90,368.50 after 6 years, if available ROI is 10% and compounding is Quarterly for first 2 years, Half Yearly for next 2 years and Monthly for last 2 years?

Mr. Munjal has got her daughters son admitted to a dental college today, where he has to pay a fee of Rs. 1.5 Lac today i.e. at the time of admission. Then Rs. 1.75 lacs after 1 year, Rs. 2.5 lacs after 2 years and Rs. 3.25 lacs after 3 years. He wants to set aside the amount required today itself in the form of a Bank FDR.So how much he needs to put aside today if ROI is 8% for 1 year, 8.5% for 2 years and 9% for 3 years, all compounded Quarterly?

An HUF consisted of a father, who is a widower, his three sons and a daughter. On death of the father what will the share of each of his sons?

No society shall be dissolved unless …………………of the member shall have expressed a will for dissolution by their other

If everyone is forced to pay an extra Rs 1000 in taxes each year, "the" multiplier

Any property inherited by a female Hindu from her husband or from her father in law, in the absence of any son or daughter of the deceased shall go to…..

As per rule 69 of doubling, what is the doubling period if rate of interest is 9%

A bank that handles affairs of another bank which has no legal standing in the jurisdiction is called

Urban land means land situated in area not being more than ………………from local list of local authority as notification in official Gazette

Wills which are not valid in India except in case of privileged wills or in case of Mahomadans are called as:

A muslim gentleman can leave his will, bequeathing all his properties to someone often than his legal heirs to the extent of…………….

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. Said rent is —

If POA in respect of in moveable property of value more than ………………….it must be registered

"A borrower defaults on a secured loan of Rs. 50,000. The underlying security is worth Rs. 60,000. Which of the following is true? "

Compute Geometric mean return for an investment with the following per period return – 8.9%, 10%, 7.7%, 13%?

The approach to global financial system which criticizes the modern financial system of promoting inequality between state players is called:

A person is said to be Agnate of another if the two of them are related by blood or adoption entirely or wholly through males.

The second pillar in the Basel framework seeks to help participants to assess which of the following information?

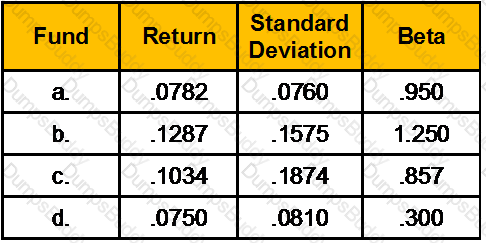

You are given the following set of data on security ABC:

Calculate the expected return on security ABC?

The minimum amount for secured lenders to take the benefit of SARFAESI is _______.

The interest payable for a housing loan outside India is not allowed as a deduction U/S 24 (1) while computing the income from house property?

If the proposer does not disclose fully all the material facts at the time of Proposal the principle violated

An insured becomes entitled for getting No Claim Bonus only at the renewal of a policy after the expiry of the full duration of _________ months.

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

What is the most essential characteristic to be in existence at the stage of establishing client relationship?

A fraud is discovered with respect to an loan that has turned NPA. When is the earliest that it can be treated as a doubtful asset?

In ULIP plans, the returns are dependent on in which the investments are done by the insurance company

A retirement planner must have detailed information about the client’s current and future assets and liabilities. Which of the following is of least importance in developing a retirement plan?

Performance measurement by benchmarking normally refers to comparing performance of a fund to

Which portion of his property can a muslim normally be guest according to muslim personal law?

What is the Relationship of Banker with the payee of a draft issued by the Bank?

Which of the following is/are not the statutory objectives of Financial Service Authority(FSA) of UK?

If there is a loss under the head Income from House property, can it be adjusted against other income under any other Head?

Compute Geometric mean return for an investment with the following per period return – 8.9%, 10%, 7.7%, 13%?

In marine insurance claims, insurable interest must shown to exist at the time of

"This is the "crowding out" theory: Increased government borrowing crowds household and business investment out of limited savings, driving up _______, but not raising total demand." Fill in the blank.