Workers’ compensation payments are excluded from gross income and employment taxes EXCEPT when the amounts received:

Which of the following forms of identification CANNOT be used in Section 2 of Form I-9?

All of the following employee information is required when reporting unclaimed wages EXCEPT:

Which of the following documents listed on Form I-9 can be used to establish both an employee's identity and employment eligibility?

An upgrade to a payroll system can impact all of the following documentation within the payroll department EXCEPT:

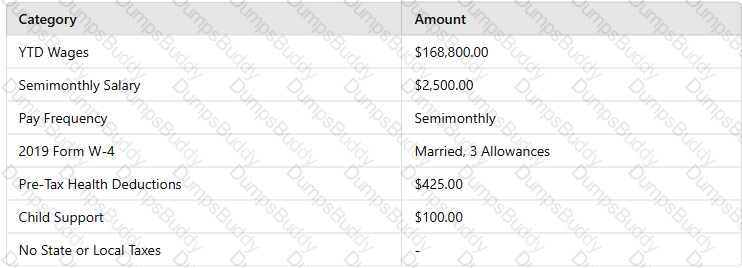

Based on the following information, using the percentage method, calculate the employee's net pay:

Even if a worker meets the definition of an employee, an employer can still treat the worker as an independent contractor if the worker passes the:

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

Under theCCPA, use the following information to calculate theMAXIMUMdeduction for the child support order for an employee whois not supporting another family and not in arrears.

When providing wage data for a workers’ compensation audit, which of the following wage types would be included as compensation?

Which of the following deductions from pay is considered a voluntary deduction?

Which of the following general ledger accounts should normally maintain a credit balance?

An employee has received $169,000.00 in YTD earnings. The employee receives a payment of $16,600.00. The employer Medicare tax, if any, is:

Failure to create a payroll ACH file is a violation of which customer service principle?

An employee hired on July 1, 2021, terminates employment on September 30, 2022. What is the earliest date the employer may dispose of the Form I-9?

Specifying a defined response time for an employee's payroll-related question is a component of a Payroll Department’s:

When resolving late deposits, the payroll staff should take all of the following steps EXCEPT:

Which of the following situations does NOT reflect constructive receipt of wages?

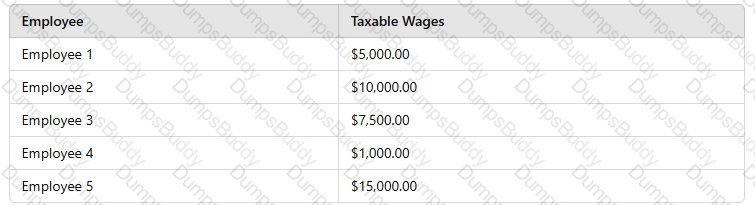

Using the table of taxable wages below, calculate the employer'sFICA tax liabilityon the first check of the year:

Employers can take advantage of all of the following affordability safe harbors set forth in the ACA regulations EXCEPT:

Depositors that fail to deposit the entire amount of tax required by the due date, without reasonable cause for the failure, are subject to a failure-to-deposit penalty of 5% of the undeposited amount if it is:

When a payer receives a “B” Notice, it must send a copy of the notification to the payee within:

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

IRS regulations require employers to take all of the following actions for taxable noncash awards EXCEPT:

Using the following information from a payroll register, calculate the tax deposit liability for the payroll.