F1 Financial Reporting Questions and Answers

BBB has been experiencing liquidity problems and currently has an overdraft with the bank.

Which THREE of the following would be appropriate measures to help address this problem?

UV's financial statements for the year ended 31 March 20X8 were approved for publication on 30 June 20X8.

In accordance with IAS 10 Events After the Reporting Period, which of the following material events would have been classified as a non-adjusting event in these financial statements?

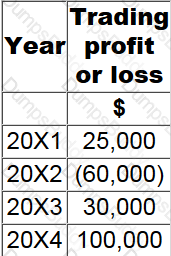

In 20X4, DEF closed its business having made a trading loss of $160,000. In DEF's country of residence, trading losses may be carried back three years on a LIFO basis.

The profits for the last four years of trading were:

What are the taxable profits or losses for years 20X1 and 20X2?

In accordance with the Conceptual Framework for Financial Reporting, which TWO of the following qualitative characteristics of useful financial information should be considered when selecting a measurement basis?

Which THREE of the following are included in the International Accounting Standards Board's "The Conceptual Framework for Financial Reporting"?

An entity purchased an asset for $375,000 on 1 November 20X0 incurring legal fees of $33,000. Improvements were made to the asset for $65,000 on 1 December 20X2 which qualified as capital expenditure under the local tax rules. The entity also incurred repair costs on the asset on 1 February 20X3 amounting to $10,000.

The asset was sold for $680,000 on 1 December 20X5 incurring allowable costs on disposal of $15,000.

Indexation on the purchase cost and the improvement are allowable.

The index increased by 20% between November 20X0 and December 20X5,15% between December 20X2 and December 20X5 and 10% between February 20X3 and December 20X5

Calculate the chargeable gain on the disposal of the asset on 1 December 20X5.

On 31 March 20X1 OP decided to sell a property. On that date this property was correctly classified as held for sale in accordance with IFRS 5 Non-Current Assets Held For Sale And Discontinued Operations.

In the draft financial statements of OP for the year ended 31 October 20X1 this property has been included at its fair value, which was $520,000 lower than its carrying value. This has resulted in a charge to profit or loss, the result of which is that the draft financial statements show a loss of $450,000 for the year to 31 October 20X1. When the management board of OP reviewed the draft financial statements it was unhappy about the loss and decided that the property should be reclassified as a non-current asset and reinstated to its original value, despite the fact that its plans for the property had not changed.

In accordance with the ethical principle of professional competence and due care, which THREE of the following statements explain how this property should be accounted for in the financial statements of OP for the year ended 31 October 20X1?

Which THREE of the following are included within an entity's statement of profit or loss?

When calculating the gam chargeable to tax on the disposal of a building, which of the following would NOT be an allowable deduction?

The following information relates to ABC.

Which of the following would be a reason for the movement in the trade receivable days?

XYZ operates in Country A where tax rules state that entertaining costs and donations to political parties are disallowable for tax purposes.

XYZ calculated both its accounting and taxable profits for the year ended 31 December 20X2 after deducting $10,000 of entertaining costs.

It is considering what impact the ruling that "entertaining costs are disallowable for tax purposes" will have on its two profit figures.

Which of the following correctly states the impact of the ruling on the profits already calculated?

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is $28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What cash outflow figure should be included within cash flows from investing activities for the purchase of property, plant and equipment?

Mr K is being pressured by his manager to change figures in his report so that it will improve his manager's bonus.

His manager has promised Mr K a promotion if he agrees to do this.

What threats is Mr K facing?

In Country X, trading losses in any year can be carried back and set off against trading profits in the previous year, with any unrelieved losses carried forward to set against the first available trade profits in future years.

GH had the following taxable profits and losses in years 20X1 to 20X4:

What are the taxable profits for 20X4, assuming the most efficient use of the loss is made?

EF purchased an asset on 1 September 20X4 for $800,000, exclusive of import duties of $30,000. EF is resident in country Y where indexation is allowed on purchase costs when the asset is disposed of.

EF sold the asset on 31 August 20X9 for $1,500,000 incurring transaction charges of $20,000. The indexation factor increased by 40% in the period from 1 September 20X4 to 31 August 20X9.

Capital gains are taxed at 30%.

What is the tax due on disposal of the asset?

XY acquired 75% of the equity shares of CD on 1 January 20X2 for $230,000.

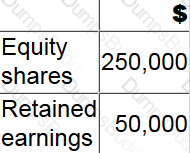

On 1 January 20X2 CD had the following balances:

XY uses the proportionate share of net assets method to value non controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of CD.

Give your answer to nearest whole number.

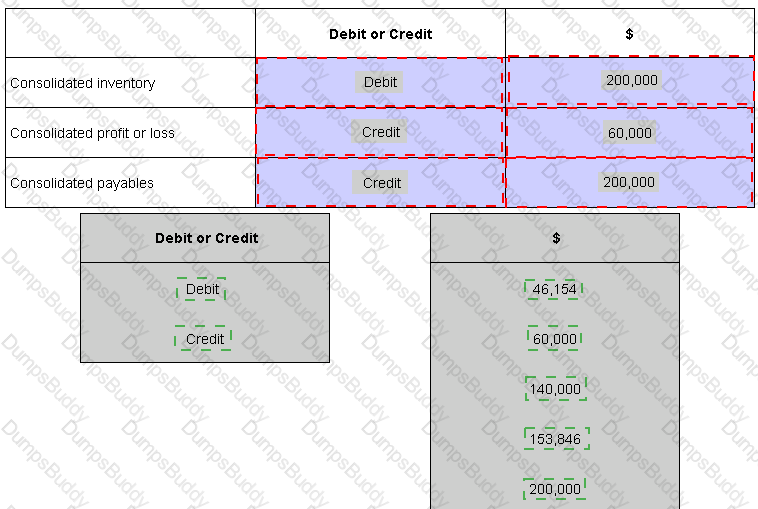

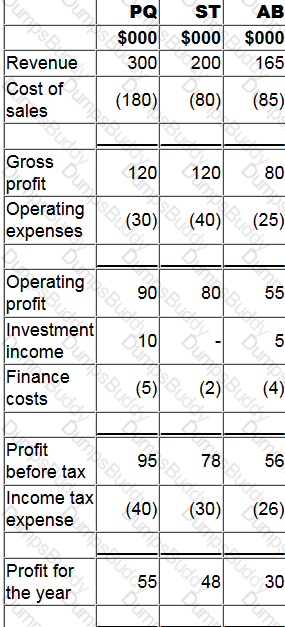

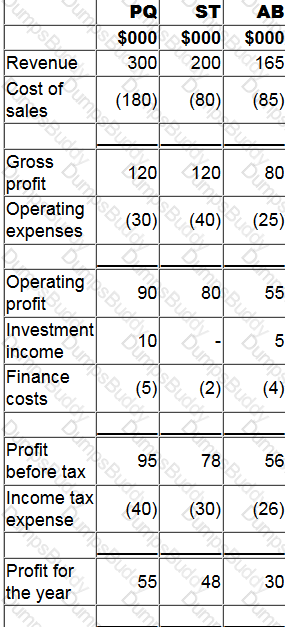

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0?

Country J is a newly formed independent country and it's accounting professionals are considering adopting international financial reporting standards (IFRS).

Which of the following is a disadvantage to Country J of adopting IFRS as their local generally accepted accounting practice (GAAP)?

Which THREE of the following are part of the International Accounting Standards Committee (IASC) Foundation structure?

The IV Group is formed of I Ltd and its subsidiary company V Ltd. I Ltd purchased 67% of V Ltd's ordinary share capital on 31 March 20X3.

The purchase cost I Ltd £129,000. At the date of purchase V Ltd's net assets were £155,000 while its share capital was £37,000. NCI fair value on the date of acquisition was £31,000.

What was the amount of goodwill I Ltd paid as part of the acquisition. Calculate this figure using both the proportion of net assets method and the full good will method for valuing the non-controlling interest.

STU has a non-current asset which originally cost $250,000, has an expected life of 8 years and an estimated residual value of $25,000. The asset is depreciated at 25% a year on a reducing balance basis On 1 July 20X5 the accumulated depreciation for this asset is $109,375

What is the depreciation charge for the year ending 30 June 20X6?

Give your answer to the nearest whole number.

XYZ is a manufacturer. Which of these should be classified as other comprehensive income in XYZs statement of profit or loss and other comprehensive income for the year ended 31 December 20X4?

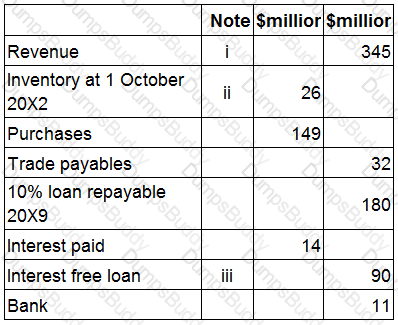

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the figure that should be included within non-current liabilities in YY's statement of financial position at 30 September 20X3 in respect of both of the loans outstanding at the year end?

Give your answer to the nearest $ million.

Which THREE of the following statements are NOT true of the IFRS Foundation trustees?

An entity had a current tax liability of $187,000 in its statement of financial position as at 30 September 20X5. It was subsequently negotiated and eventually agreed with the tax authorities that the entity would pay $192,000 and this was paid on 6 January 20X6.

The entity's management estimate that the tax due on profits for the year to 30 September 20X6 is $231,000.

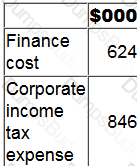

Calculate the entity's corporate income tax expense included in its statement of profit or loss for the year ended 30 September 20X6.

Give your answer to the nearest whole $000.

The following data has been extracted from GH's accounting records:

What is GH's average inventory days for the year ended 31 March 20X3?

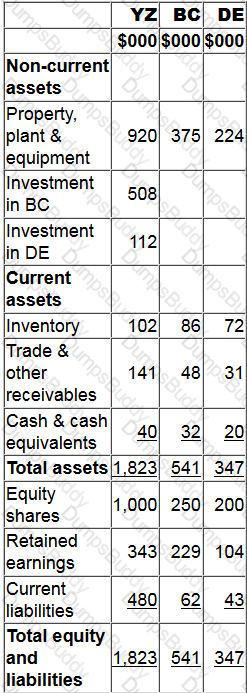

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the amount of the non-controlling interest to be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

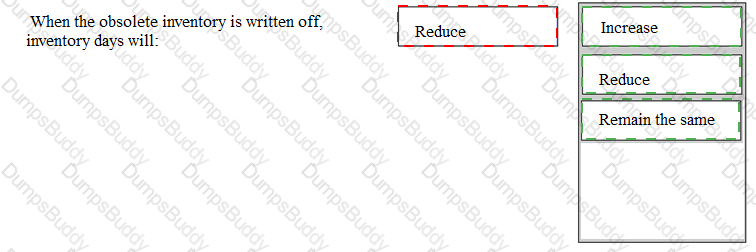

An entity's inventory days are 45 days.

An entity ceased to manufacture a product in 20X4. Raw materials used solely in the manufacture of that product are still held in inventory at 31 December 20X4.

Place the appropriate response below to show how inventory days will be affected if this raw material inventory is written off as obsolete.

Which of the following correctly identifies the order of the steps involved in the development of an International Financial Reporting Standard prior to it being issued?

Company Y is using some of the money from a share issue to purchase a new office building. The company is also using some of the money to purchase inventories. Which method of financing is this?

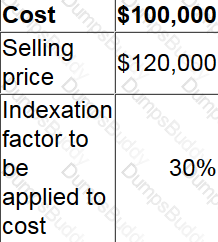

Country ZZ allows the cost of a capital asset to be adjusted for an indexation allowance which takes into consideration the effect of inflation, although the indexation allowance cannot convert a chargeable gain into a chargeable loss.

The following data relates to the sale of an asset ABC has the following working capital ratios at 31 December 20X2:

Dunng the year ended 31 December 20X4 credit purchases wefe $1,700,000 and at 31 December 20X4 the outstanding trade payables balance was $340,000

Calculate the working capital cycle for ABC.

Give your answer to the nearest whole number of days and assume there are 365 days in a year. March 20X4:

Calculate the chargeable gain or loss in respect of the sale of this asset.

Give your answer to the nearest $.

A specialized product was commissioned by a customer and the agreed price was $38,000. The product was completed at a cost of $34,000.

It was then discovered that new regulations meant that the specialized product now failed health and safety requirements. The specialized product had to be modified to meet the new regulations at a cost of $9,000. The customer agreed to pay an extra $3,000 towards the modifications.

At 31 December 20X5 the specialized product was still in inventory and had not been modified.

Calculate the value of the specialized product that should be included in inventory as at 31 December 20X5.

Give your answer to the nearest whole $000.

There are two main approaches to corporate governance: rules-based and principle-based.

Which THREE of the following are correct?

RS purchased an asset on 1 May 20X1 for $200,000, exclusive of import duties of $25,000.

The asset was sold on 1 December 20X3 for $450,000, incurring costs to sell of $15,000.

RS is resident in Country Y where indexation is allowable from the date of purchase to the date of sale.

The indexation factor increased by 40% in the period 1 May 20X1 to 1 December 20X3.

Capital gains are taxed at 25%.

What is the capital tax due from RS on disposal of the asset?

Which of the following is the most appropriate definition of the term 'factoring'?

CDE has been offering its customers a 50-day credit period, but now wants to improve its cash flow.

CDE is proposing to offer a 2% discount for payment in 20 days. "

Assume a 365-day year and an invoice value of $100

Which of the following is the effective annual interest rate CDE will incur for this action?

Which TWO of the following are implications of employee income tax being paid to the tax authority through a Pay-As-You-Earn scheme?

The following information is extracted from QQ's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

The following information if included within QQ's statement of profit or loss for the year ended 31 March 20X2.

Included within finance cost is $124,000 which relates to interest paid on a finance lease. QQ includes finance lease interest within financing activities on its statement of cash flows.

What cash outflow figure should be included as interest paid within the net cash flow from operating activities for QQ for the year ended 20X2?

Give your answer to the nearest $000.

DEF is considering introducing a Pay-As-You-Earn (PAYE) system but unsure of the advantages of using it.

Which of the following statements are advantages from the employees perspective of an entity using a PAYE system for collecting taxes from employees.

Select ALL that apply.

ABC uses an aggressive approach to managing its working capital. XYZ uses a conservative approach to managing its working capital.

Which of the following is ABC more at risk of compared to XYZ?

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

Calculate the amount that will be shown as the share of profit of associate in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0.

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

Which of the following would be classified as a parent and subsidiary relationship in accordance with IFRS 10 Consolidated Financial Statements?

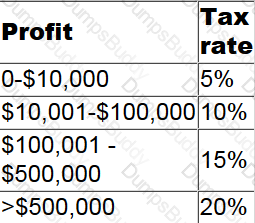

In Country X corporate income tax is levied on profits as follows:

Which of the following describes the tax rate structure in Country X?

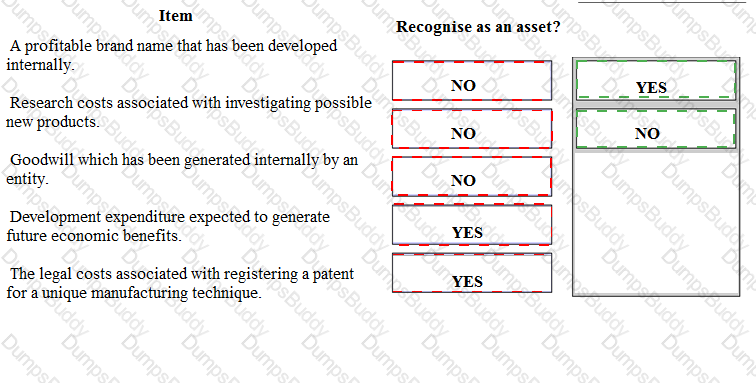

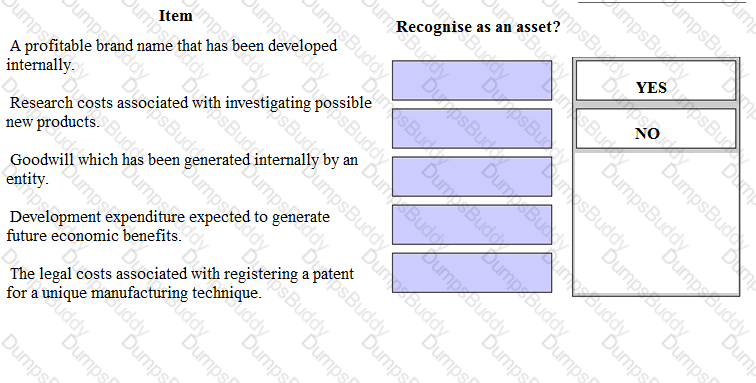

Identify from the list below which items can be recognised as assets within the financial statements of an entity in accordance with IAS 38 Intangible Assets. Place either yes or no as appropriate against each item.

HI commenced business on 1 April 20X3. Sales in April 20X3 were $30,000. This is forecast to increase by 2% per month.

Credit sales accounted for 50% of sales. Credit sales customers are allowed one month to pay; 75% of April credit customers paid on time. A further 20% are expected to pay after more than one month, but before two months. The remaining 5% are not expected to pay. All these percentages are expected to continue in the near future.

Calculate the total amount of cash HI should forecast to be received in June 20X3.

Give your answer to the nearest whole $.

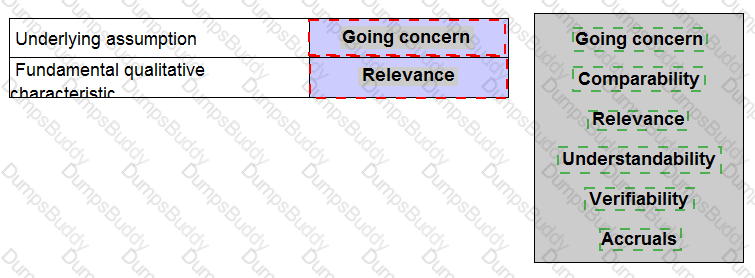

The Conceptual Framework for Financial Reporting issued by the International Accounting Standards Board (known as the IASB's conceptual framework) includes one underlying assumption about the preparation of financial statements and two fundamental qualitative characteristics for financial information.

Identify the underlying assumption and one of the fundamental characteristics by placing one of the options in each of the boxes below.

AAA has the following working capital ratios at 30 March 20X4:

During the year ended 30 March 20X4 credit purchases were $3,600 and at 30 March 20X4 the outstanding trade payables amounted to $522.

The year ended 30 March 20X4 was not a leap year.

Calculate the working capital cycle for AAA.

Give your answer to one decimal place.

For the year ending 31 March 20X2, MN made an accounting profit of $120,000. Profit included $8,500 of political donations which are disallowable for tax purposes and $8,000 of income exempt from taxation.

MN has $15,000 of plant and machinery which was acquired on 1 April 20X0 and purchased a new machine costing $25,000 on 1 April 20X1. This new machine is entitled to first year allowances of 100% instead of the usual tax depreciation of 20% reducing balance. All plant and machinery is depreciated in the accounts at 10% on cost.

MN also has a building that cost $120,000 on 1 April 20X0 and is depreciated in the accounts at 4% on a straight line basis. Tax depreciation is calculated at 3% on a straight line basis.

Calculate the taxable profit.

Give your answer to the nearest $.

When a trading loss is incurred by an entity, the entity may be able to claim loss relief. The way in which loss relief is claimed vanes from country to country.

Which of the following is NOT normally a way of claiming loss relief for a trading loss?

An entity has a working capital cycle of 120 days which has been calculated in part from the following data:

What is the stock holding period on the basis of 365 days in a year?

Give your answer to the nearest whole day.

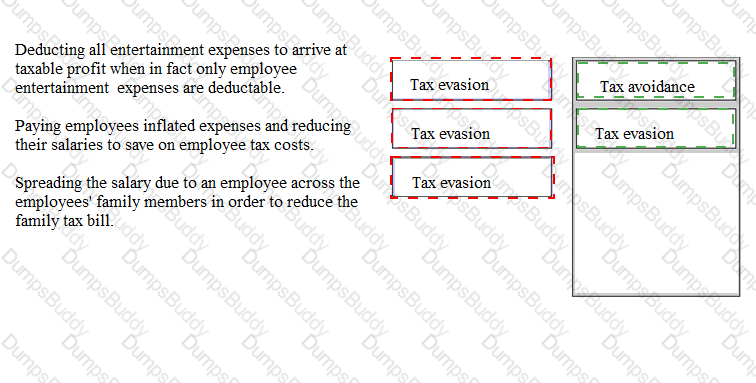

Identify whether the scenarios below are examples of tax evasion or tax avoidance, by placing either tax evasion of tax avoidance against each one.

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the goodwill arising on the acquisition of BC.

Give your answer to the nearest whole $.

The following information relates to a single asset:

*Original cost of $186,000

*Estimated residual value of $6,000

*Expected useful life of 10 years

*Accumulated depreciation at 31 December 20X5 of $66,960

*Annual depreciation rate of 20% on a reducing balance basis

Calculate the amount of depreciation that should be charged to profit or loss for the year ended 31 December 20X6.

Give your answer to the nearest whole number.

Which THREE of the following actions, considered in isolation, would increase the working capital cycle of an entity?

Which of the following is NOT a principle in the CIMA Code of Ethics for Professional Accountants?

XY purchased a building on 1 April 20X1 for $300,000 with a useful economic life of 30 years. On 1 April 20X7 the building was revalued at $525,000.

What will the new depreciation charge be following the revaluation?

Give your answer as a whole number.

Which THREE of the following are conditions that must be met to allow an asset to be categorised as held for sale?

Country X levies a duty on alcoholic drinks. Where the alcohol content is above 40% by volume the duty levied is $5 per 1 litre bottle.

What type of tax is this duty?

Extreme nepotism within Company E shows a failure to correctly observe which of the following principles of corporate governance?

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the cost of sales that would be shown in YY's statement of profit or loss for the year ended 30 September 20X3.

Give your answer to the nearest $ million.

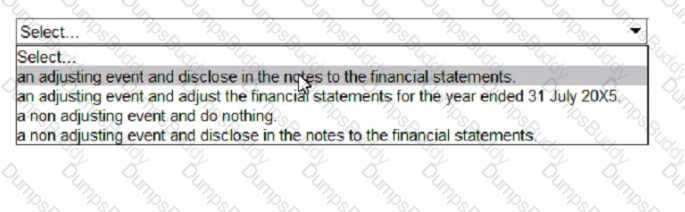

AB has prepared its financial statements for the year ended 31 July 20X5. On 15 September 20X5 a major fraud was uncovered by the external auditors which had taken place during the year to 31 July 20X5 The financial statements have not yet been authorised

In accordance with IAS 10 Events After the Reporting Period, AB should treat the fraud as: