Which of the following could be considered a weakness of a forecast derived by regression analysis?

A main characteristic of a company with regional offices using a centralized treasury function is:

Company X, a US based multi-national, is exploring the option of locating a subsidiary in another country where there has been some historical risk of expropriation of local assets of foreign corporations. Therefore, as part of the risk assessment process the company must specifically quantify the:

The MOST effective way to reduce the internal risk of technology as it relates to critical treasury functions is to:

When projecting the closing cash position, a cash manager must estimate which of the following?

A U.S.-based electronics company that buys components from one of its foreign subsidiaries at a price above market is likely to:

Which function involves evaluating alternative projects in relation to one another and in relation to the company's cost structure?

An airline wants to lock in the price of the jet fuel it needs to purchase to satisfy the peak in-season demand for travel. The airline wants to manage its exposure to fluctuations in fuel prices. What type of exposure is this?

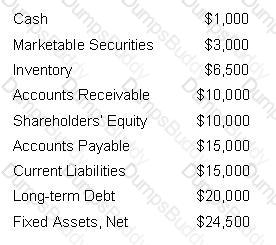

Refer to the following information about a company at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%.

What is the company's long-term debt to total capitalization ratio?

The delay between the time a check is deposited and the time the company's account is credited with collected funds is known as:

An employer wishing to reduce operating income volatility would MOST LIKELY offer what type of retirement option to its employees?

Which of the following is NOT a method multinational companies (MNC) use to repatriate capital?

What activity should the Treasurer be most interested in if core treasury functions were to be compared within the industry or cross-industry for the purpose of identifying “best practices”?

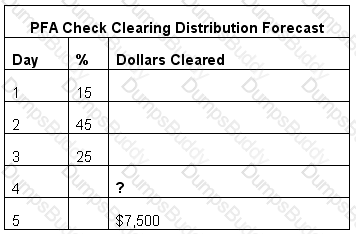

PFA Corporation has used regression analysis based on historical data to determine the estimated portion of dollars of checks issued that will clear on any given business day.

If PFA issued $150,000 in checks and $7,500 worth of checks cleared on day 5, what value of checks will be estimated to clear on day 4?

An arrangement in which a borrower makes periodic payments to a separate custodial account that is used to repay debt is known as a:

XYZ Company has decided to purchase a close competitor. This acquisition would make XYZ Company the 4th largest in its industry allowing it better purchasing power and greater distribution channels. After completing the M&A analysis, it is determined that the combined companies would produce a 40% increase in revenue, reduce manufacturing costs by 30%, but would increase current liabilities by 27%. Which of the following would keep the acquisition from happening?

XYZ Company has a well established commercial paper (CP) program that they use to fund operations. The company is expanding by purchasing a new factory. The CFO is worried about the time and expense needed to issue long-term debt and decides to use the funds they raise in the CP market to pay for the purchase of the factory. This strategy will be successful if:

During a company’s cash flow analysis review it discovers that for every 10 new customers it gains, there is an increase of 2% in its float costs associated with the payment methods it offers. If the company pursues faster collection methods for payments, resulting in greater availability of surplus cash with a correlating decrease in the need to issue commercial paper, what risk will the company mitigate?

An intern was hired by the Vice President of Accounts Payables to process the electronic payments that come through the bank. The intern is responsible for manually entering payee information into the system at each step of the process. The VP directed the intern to enter the information as fast as possible without mistakes to optimize the number of transactions that could be processed. Instead of manually entering information the VP should have utilized:

RAL Capital, a lean global financial service provider with revenues of $8 billion, has 10 regional offices located around the world. The RAL global trading groups are structured as profit centers with each center having its own profitability targets. The group’s clients consist of large multinational corporations and financial institutions that require the buying and selling of large amounts of currency. The Treasurer is considering reorganizing his department into a profit center. The group processes millions of transactions every year. What is a downside of this scenario?

The Treasurer of a company would like to establish an investment policy for the organization. One objective that should be included in the investment policy that would BEST allow the organization to limit its exposure to a particular market sector would be to:

Company GRA has retail locations in remote areas of Montana. All banking options within the area, deemed a safe distance for making cash deposits, fail the counterparty risk assessment. Deposits would include both cash and checks. In order to achieve immediate availability of funds, what deposit method should be utilized?

Which of the following is a KEY objective when instituting a collection and concentration policy?

Company XYZ offers a retirement plan wherein the value of the plan’s assets and liabilities is measured separately. The plan’s funding and valuation can have a significant impact on the financial condition of the company. Company ABC offers a retirement plan wherein the amount owed to the participants at retirement is based solely on the account balance at the time of withdrawal with participants often bearing the responsibility for managing the investments in their account. Which of the following BEST describes the above two retirement plans and which act governs them?

XYZ Bank would like to conduct some foreign exchange transactions with JKL Bank. JKL isn’t the most liquid and could have some credit risk. XYZ Bank should suggest which of the following in order to eliminate risk?

XYZ Company experienced a substantial monetary loss due to over exposure to one particular sector of the stock market. The Treasurer had invested in companies tied to five different sectors, but violated the company investment policy by exceeding a 10% limit for any sector. In developing its investment policy, what should XYZ Company have considered to prevent this scenario?

The Treasury Manager is forecasting sales based on historical data. It was observed that sales decreased sharply in December last year, normally a high sales volume period. Further investigation indicated that a severe winter storm was experienced across the Southeastern United States. How should this event be classified in the forecast when considering the sales trends?

A large, nation-wide, retailer of plumbing fixtures is considering implementing ACH technology to improve its accounts receivable processing. Which of the following pre-authorized ACH transactions can the company use for this application?

An investor concerned about taxes on dividend distributions will MOST LIKELY purchase stock on which of the following dates?

Company A is a large public company with annual revenue of $1.2 billion and high fixed costs. Its stock is listed on the New York Stock Exchange. Company B is a mid-sized company with annual revenue of $100 million and low fixed costs. Its stock is listed on the NASDAQ. Which of the following statements is MOST LIKELY to be true when comparing Company A and Company B?

A public company’s risk profile is currently in balance. The management’s mission statement is to minimize stock devaluation. However, it is forecasting a need for working capital in the short term. Which of the following solutions would BEST assist management in accomplishing its mission?

An instrument that gives the right to buy a stated number of shares of common stock at a specified price is known as:

Company A regularly modifies its capital structure by repurchasing stock. Which one of the following is a true statement?

ABC Company is a national retail company and uses XYZ Bank for its collections and payroll services. XYZ has recently experienced financial problems; what is the greatest risk to ABC Company?

Which of the following instruments simplifies the paperwork connected with loans that have multiple advance features?

An analyst for a landscaping company wants to adjust her cash-flow forecast to account for the seasonality of outflows. How can this be accomplished?

A company’s capital structure includes $800,000,000 in total capital, of which $200,000,000 comes from debt. The firm’s after-tax cost of debt is 6%, and its cost of equity is 12%. The marginal tax rate is currently 40%. What is the company’s weighted average cost of capital?

Financing decisions in a budget are used to construct all of the following pro forma financial statement components EXCEPT:

A company sells products to customers on credit, generating accounts receivable. The company uses the accrual accounting method. Once the company collects good funds from its customers, what is the impact on the financial statements of the company?

Representations and warranties in a loan agreement refer to which of the following?

Which of the following short-term instruments is used to finance the import or export of goods?

To increase the money supply, the Federal Reserve would increase which of the following?

Under which of the following circumstances is lengthening the disbursement mail float NOT a benefit to the disbursing company?

A grocery store chain would be likely to use all of the following services EXCEPT:

Which of the following statements is true about a forward foreign exchange contract?

A convenience store chain would typically use which of the following types of collection systems?

A good credit rating has which of the following effects on debt?

I. Improved marketability

II. Decreased cost of funds

III. Decreased maturity

IV. Increased dealer fees

All of the following statements are true about adjustable-rate preferred stocks EXCEPT:

Components of a field banking system include which of the following?

I. Local bank

II. Concentration bank

III. Lockbox bank

Which of the following are interest-bearing instruments?

I. Certificates of deposit

II. Treasury bills

III. Treasury notes

IV. Banker's acceptances

The time between when the payor mails the check and the payee receives available funds is known as:

Which of the following are commonly used for financing accounts receivable?

I. Factoring

II. Issuing credit cards

III. Revolving bank loans

IV. Letters of credit

To strengthen outside auditor independence with regard to publicly held companies, the Sarbanes-Oxley Act requires that:

Which of the following capital budgeting methods ignores the time value of money?

When a company decides to discontinue a product line or divest of a subsidiary, it has made what type of corporate financial decision?

Which of the following will MOST LIKELY be affected when a company changes its terms from net 30 to 2/10 net 30?

Fluctuations in interest rates and the availability of funds are more significant risks for companies that rely on:

James Corp has a 7.98% WACC and an assumed tax rate of 30%. James Corp employed €70,000,000 of capital (long-term debt and equity) in a project that generated an operating profit of €9,500,000, after depreciation expense of €300,000. EVA in this case would be:

Which of the following are differences between securities issued through the primary and private capital markets?

I. Cost of issuance and speed of execution

II. Investor base

III. Reasons for the offering

IV. Registration requirements

Which of the following ASC X12 transactions is used to confirm the receipt and compliance of transmitted sets?

An accountant is fired after reporting to the SEC that she witnessed the CFO inappropriately reduce expenses ahead of the quarterly earnings announcement. Which of the following would apply?

A U.S. exporter has agreed to export goods to a Canadian buyer with net 30 payment terms due in Canadian dollars. What type of risk is the exporter exposed to?

The delay between the time a lockbox site receives a check and the check is deposited is called:

A manufacturing company's long-term capital structure is 30% debt and 70% equity, its cost of equity is 10%, its average cost of debt is 8%, and the marginal tax rate is 34%. If the company has invested total capital of $567,865 in its production unit and the unit's operating profit is $79,856, what is the economic value added (EVA) of the unit?

Which of the following fundamental factors involved in determining an operational risk management strategy is most affected by the new corporate governance standards and “whistle-blower” laws?

Which of the following correctly describes pooling as practiced in the European cash management environment?

A company agrees to pay ¥10,000,000 for a shipment from Japan. At the time the purchase order is placed the exchange rate is ¥168/US$. At the time of payment the exchange rate is ¥163/US$. What is the net effect on the dollar cost of the shipment if the transaction has NOT been hedged?

Under an operating lease, possible benefits to the lessee include which of the following?

I. It requires no initial capital outlay.

II. It can be structured as an off-balance-sheet item.

III. It can offer tax advantages.

Which of the following are KEY issues to be considered when establishing a shared service center (SSC)?

I. Selecting the location

II. Comparing an SSC structure to outsourcing of a process

III. Choosing and implementing the technology for SSC

IV. Choosing the collection bank

Major Manufacturing Inc. (MMI) is a manufacturer of customized restaurant equipment. MMI's supplier relations policy is to take advantage of trade discounts, when available. All suppliers offer payment terms of 1/10, net 30. MMI invoices customers at the end of its 30-day manufacturing cycle. Which of the following is the correct chronological sequence of the events listed?

1. Customer invoice is sent.

2. Supplier payment is sent.

3. Customer payment is received.

4. Order is shipped.

5. Customer order is received.

6. Supplier order is placed.

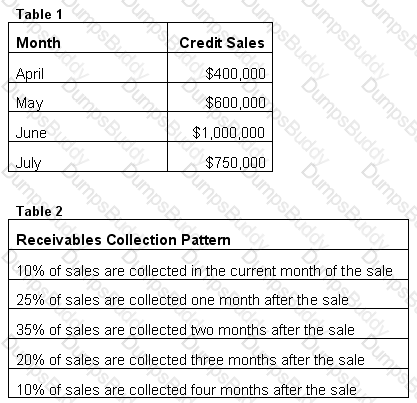

The company's monthly credit sales are in Table 1 and its receivables collection pattern is in Table 2. If this company wishes to achieve a second quarter (April-June) DSO of 60 days, what would its ending accounts receivable balance need to be?

Assume a 90-day quarter.

If a bank has a 10% reserve requirement, a 31-day month, and an earnings credit rate of 6.5%, which of the following is the approximate level of collected balances required to support $1.00 worth of bank service charges?

A merchant presents 2 different batches of credit card transactions for processing, each batch has the same dollar value and number of transactions, but the fees are different. Which of the following explains why?

All of the following are common consumer-to-corporate international payment mechanisms EXCEPT:

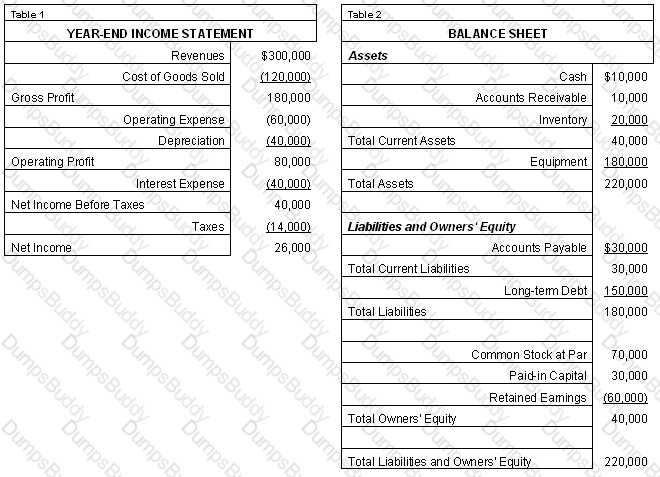

The year-end income statement for a company is presented in Table 1. The balance sheet is presented in Table 2.

What is the company's return on equity?

A pizza restaurant chain maintains separate accounts at bank branches near each of their 1,067 restaurants to handle the deposit of cash received. Early each morning, the company’s point-of-sale system electronically transmits collection totals from the previous day to its main computer. ACH debits are then initiated to concentrate the funds from the local accounts to the concentration account the following day. Recently, several of the ACH debits have been returned for insufficient funds because deposits weren’t being taken to the bank on a timely basis by the local employees. Without increasing staff at the restaurants, what could Treasury do to prevent this from happening and avoid overdrafts at the local banks?

Which of the following ACH formats is commonly used for consumer payments such as deposits of payroll?

A cash manager's recommendation to use procurement cards as a way to reduce accounts payable expense is an example of:

A small import/export company, XYZ Company, has recently set up an account with a German firm. The contract between the companies states that XYZ is to be paid as soon as all documents are in order showing that the transaction terms have been met. Which of the following forms of payment drafts would be MOST appropriate for XYZ?

Assuming a marginal tax rate of 36%, the taxable equivalent yield for an investment with a tax-exempt yield of 3% would bE.

U.S.-based manufacturing Company XYZ is looking to deliver finished goods to ABC Company in a developing nation. The credit department wants to ensure collectability and has asked the treasury department for guidance. The desired solution may impact days sales’ outstanding but will have the lowest credit risk to Company XYZ. What will treasury recommend?

What is the MOST appropriate financial plan when a corporation wishes to establish its overall goals and objectives over a period of time?

A globally diversified manufacturing company can manage its liquidity more effectively by:

A farmer who plans to sell his/her corn crop in three months would benefit MOST from which of the following?

In order to reduce the premiums paid to insurance companies, a company should consider retaining or self insuring for:

The cash manager for a company is creating a list of transactions that should be considered when determining the daily projected closing cash position. Which of the following transactions should be removed from the list?

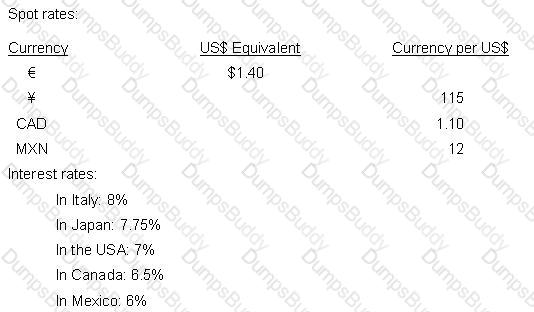

Which currency will sell at the greatest discount in the forward market against the U.S. dollar?

Multinational corporations repatriate funds from foreign operations through which of the following?

At the time of the initial debt contract, the only way debt holders can protect their interests effectively is to establish certain provisions or covenants designed to:

ABC Company offers trade terms of 2/10 NET 30. For several reasons, ABC has decided to eliminate the requirement for a letter of credit from one of its customers. If ABC puts the customer on open book credit, what is the MOST LIKELY outcome?

A company's lockbox bank, which processes 24 hours per day, has a 6:00 P.M. ledger credit cutoff and grants same-day availability on checks drawn on Bank B that are received by 10:00 P.M. Which of the following ledger and collected credit postings would result from a Bank B check received at 11:00 P.M. on Tuesday?

XYZ Company has decided to transition the responsibility for its hedging activities from the local offices to the head office; however, the local offices will continue to choose their own depository banks. Under the new structure, XYZ’s treasury operations will be:

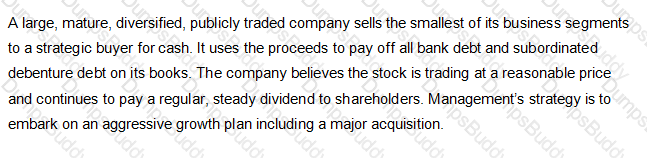

Based on the above information, before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

Companies implement EDI in order to realize which of the following benefits?

I. Decreased error rates

II. Decreased order lead time

III. Improved productivity

IV. Improved cash forecasting

The amount of the discount required to renegotiate credit terms in EDI depends on which two of the following?

I. Present value impact of the timing change

II. Credit risks involved

III. Revolving credit agreements

IV. Transaction costs savings

Advantages of writing checks locally on a centralized disbursing bank include all of the following EXCEPT which statement?

Which of the following activities creates administrative costs associated with a concentration system?

Which cost benefit analysis technique uses the methodology to find where the present value of each project’s cash inflows equals the present value of each project’s outflows?

The year-end income statement and balance sheet accounts for a company as of December 31, Year 1 are shown in the Exhibit.

If no changes occurred in the current asset and current liability account balances from the beginning of the period, except for cash, what was the net cash flow from operations for Year 1?

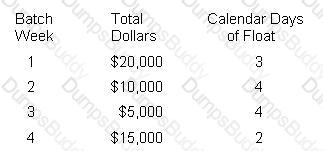

The lockbox receipt records for one 30-day month are provided below. The opportunity costs are 10%.

What is the annual cost of float rounded to the nearest dollar?

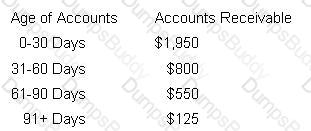

A company has average monthly sales of $2,700, of which 5 percent is on a cash basis, with the remaining sold on open account. The company's accounts receivable aging schedule at the end of March is as follows:

What is the company's DSO?

Which of the following is an example of using cash forecasting for liquidity management?

Which of the following would be used to evaluate only the effects of varying interest rates while holding all other values constant at their expected levels?

In an international banking system, what role is commonly carried out by a large group of clearing banks?

Making payments through electronic payments networks can be a part of a treasury management system’s functionality, but it is subject to numerous constraints. Which of the following is a true statement of those constraints?

A company which experiences increased business volumes but a minimal increase in profitability MOST LIKELY has:

A dealer is selling securities to a client. What is the yield/price at which the dealer will sell?

An analyst is performing a lease versus buy analysis on a corporate jet. In the evaluation, a cost is relevant if it is:

Usually, corporations receiving dividends from another corporation can exclude 70 percent of dividend payments from income for tax purposes as long as the stock is owned for at least:

JKL Company has been successful in shortening the time associated with its mail float, processing float and availability float. JKL Company will experience which of the following as a result of these improvements?

The yield on any short-term investment instrument is a function of the maturity or holding period, the amount paid and:

An institutional investor has purchased an investment that provides a fixed rate of return with some potential for delays in payments. The return is 70% tax deductible for this particular investor. What type of investment was MOST LIKELY purchased?

What document serves as the basic account or service authorization, empowering a representative of a business to enter into agreements for financial services?

XYZ Inc. is a publicly traded company with revenues of $1B and an operating profit of 7.5%. The treasury organization consists of a treasurer and an assistant treasurer. The assistant treasurer is responsible for the creation and approval of all payments. The treasurer is responsible for compilation of the financial statements. Under Section 404 of the Sarbanes-Oxley Act, what should be viewed as a concern?