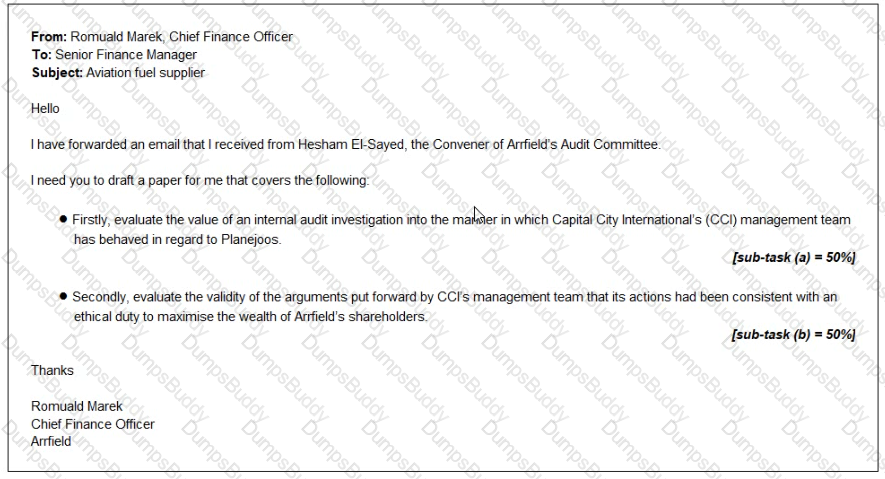

A month later, you receive the following email:

Reference Material:

From: Hesham El-Sayed. Independent Non-executive

Director

To: Romuald Marek. Chief Finance Officer

Subject: Collapse of fuel supplier

Hi Romuald

I am writing to give you some advance notice of an internal audit investigation that has been commissioned by the Audit Committee

Just over a year ago. Planejoos, a newly formed company, approached the management team at Airfield's Capital City International (CCI) airport and offered to take over refueling operations at Starport Planejoos offered a higher percentage of revenue than the existing supplier was paying CCI's management team agreed and appointed Planejoos rather than renew the existing supplier's contract.

CCI was unable to conduct the usual background and credit checks on Planejoos for two reasons. Firstly, Planejoos was a new company and so did not have an extensive credit history that could be checked Secondly CCI was under time pressure to reach a decision on whether to renew the existing supplier's contract or allow it to expire

CCI's management team claimed that it had acted quickly in order to benefit from the additional revenue that could be earned from dealing with Planejoos The management team was acting on the basis that it had an ethical duty to maximise the wealth of Airfield's shareholders and that maximising revenues from fuel sales through this agreement with Planejoos was consistent with that ethical duty.

Unfortunately, as a new company. Planejoos struggled to obtain trade credit and the high demand for fuel put the company's cash flows under extreme pressure Receipts from sales lagged behind payments for inventory Planejoos has now collapsed, leaving a large trade receivable that CCI will have to write off as uncollectable CCI had permitted this receivable to accumulate rather

than pressing for payment and so putting Planejoos under further pressure.

Fortunately, the previous fuel supplier was prepared to return to CCI.

Kind regards

From: Martin Wills, Head Geologist

To: William Seaton, Director of Finance

Subject: Reserves

Hi William,

I have reviewed the situation with respect to our “probable” or “2P” reserves, as disclosed in our latest annual report. I am sorry to say that we have to downgrade our figures with respect to reserves. I am recommending that all extraction activities cease for the foreseeable future on the North Atlantic and South Atlantic fields and that the proved reserves be downgraded from proved to probable.

I have to stress that this is not attributable to any past error on the part of the geologists. The world oil price has been depressed and the discovery of large deposits of shale oil in the USA suggests that the oil price will not recover for some time. That means that some oil wells that were commercially viable this time last year are no longer worth processing.

The oil remains under the rock and I have no doubt that we will restore operations in the long term.

We are by no means the only oil company to have been forced to take this action.

The one piece of good news is that the financial statements for the year ended 31 December 2014 have already been published. My understanding is that we do not have to withdraw them, so unless you put an advertisement in the press, we can carry on quietly trying to sort this mess out.

I have my best people working on ways to extract oil from our wells more efficiently, so we may be able to increase production over the next year or so.

Martin

From: Jan Archibald, Group Chief Financial Officer, Fouce Oil

To: William Seaton, Director of Finance

Subject: Sale of oil fields

Dear William,

As you know, the Board of Fouce Oil is keen that you should operate in an autonomous manner. However, we believe that it is our duty to ask you to reconsider a key issue in Slide’s approach to doing business.

Over the years you have been very successful indeed in finding significant oil fields and bringing those to production. We have been gratified to observe your efforts in doing so and we believe that all shareholders have benefitted from the wealth that you have created.

The Board of Fouce Oil believes that the time has come for Slide to stop giving the fruits of its labour away to other companies. We believe that Slide should retain any successful oil wells and start to earn revenues from the sale of the oil itself rather than the sale of the oil wells. We believe that the stock market would respond favourably to such a development, to the mutual benefit of all.

Best Wishes

Jan