What isthe risk horizon period used for credit risk as generally used for economic capital calculations and as required by regulation?

Calculate the 1-year 99% credit VaR of a portfolio of two bonds, each with a value of $1m, and the probability of default of 1% each over the next year. Assume the recovery rate to be zero, and the defaults of the two bonds to be uncorrelated to each other.

Under the actuarial (or CreditRisk+) based modeling of defaults, what is the probability of 4 defaults in a retail portfolio where the number of expected defaults is2?

Pick underlying risk factors for a position in an equity index option:

I. Spot value for the index

II. Risk free interest rate

III. Volatility of the underlying

IV. Strike price for the option

Which of the following is not an approach proposed by the Basel II framework to compute operational riskcapital?

Which of the following are ordered correctly in the order of debt seniority in a bankruptcy situation?

I. Equity, Subordinate debt, Senior debt

II. Senior debt, Preferred stock, Equity

III.Secured debt, Accounts payable, Preferred stock

IV. Secured debt, DIP financing, Equity

Which of the following is the most important problem to solve for fitting a severity distribution for operational risk capital:

Which of the following situations are not suitable for applying parametric VaR:

I. Where the portfolio's valuation is linearlydependent upon risk factors

II. Where the portfolio consists of non-linear products such as options and large moves are involved

III. Where the returns of risk factors are known to be not normally distributed

Which of the following statements is NOT true in relation to the recent financial crisis of 2007-08?

Which loss event type is the failure to timely deliver collateral classified as under the Basel II framework?

There are three bonds in a diversified bond portfolio, whose default probabilities are independent of each other and equal to 1%, 2% and 3% respectively over a 1 year time horizon. Calculate the probability that exactly 1 of the three bonds will default.

Which of the following data sources are expected to influence operational risk capital under the AMA:

I. Internal Loss Data (ILD)

II. External Loss Data (ELD)

III. Scenario Data (SD)

IV. Business Environment and Internal Control Factors (BEICF)

The probability of default of a security over a 1 year period is 3%. What is the probability that it would not have defaulted at theend of four years from now?

Which of the following represents a riskier exposure for a bank: A LIBOR based loan, or an Overnight Indexed Swap? Which of the two rates is expected to be higher?

Assume the same counterparty and the same notional.

Under the CreditPortfolio View approach to credit risk modeling, which of the following best describes the conditional transition matrix:

Which of the following is true for the actuarial approach to credit risk modeling (CreditRisk+):

The 99% 10-day VaR for a bank is $200mm. The average VaR for the past 60 days is $250mm, and the bank specific regulatory multiplier is 3. What is the bank's basic VaR based market risk capital charge?

The frequency distribution for operational risk loss events can be modeled by which of the following distributions:

I. The binomial distribution

II. The Poisson distribution

III. The negative binomial distribution

IV. The omega distribution

The key difference between 'top down models' and 'bottom up models' foroperational risk assessment is:

For a bank using the advanced measurement approach to measuring operational risk, which of the following brings the greatest 'model risk' to its estimates:

For a FX forward contract, what would be the worst time for a counterparty to default (in terms of the maximum likely credit exposure)

A zero coupon corporate bond maturing in an year has a probability of default of 5% and yields 12%. The recovery rate is zero. What is the risk free rate?

Identify the correct sequence of events as it unfolded in the credit crisis beginning 2007:

I. Mortgage defaults increased

II. Collapse in prices of unrelated assets as banks tried to create liquidity

III. Banks refused to lend or transact with each other

IV. Asset prices for CDOs collapsed

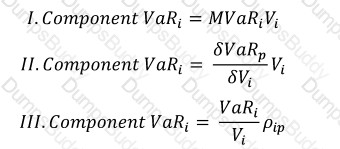

Which of the following formulae correctly describes Component VaR. (p refers to the portfolio, and i is the i-th constituent of the portfolio. MVaR means Marginal VaR, and other symbols have their usual meanings.)

As the persistence parameter under EWMA is lowered, which of the following would be true:

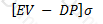

If EV be the expected value of a firm's assets in a year, and DP be the 'default point' per the KMV approach to credit risk, and σ be the standard deviation of future asset returns, then the distance-to-default is given by:

A)

B)

C)

D)

For a given mean, which distribution would you prefer for frequency modeling where operational risk events are considered dependent, or in other words are seen as clustering together (as opposed to being independent)?

The standalone economic capital estimates for the three business units of a bank are $100, $200 and $150 respectively. What is the combined economic capital for the bank, assuming the risks of the three business units are perfectly correlated?